Forming an outlook on the US equity market is challenging because there are so many moving parts. Today I want to take a look at inflation. Inflation matters a great deal. If we exceed 2% inflation, the Fed will surely move aggressively to raise interest rates further. From my research, a deceleration in GDP growth concurrent with a rise in inflation is a very bad combination for US equities.

The US equity market has been pretty volatile these last few months. The prevailing view is that the Fed may increase interest rates too aggressively and inadvertently send the US into the next downturn. Recently, the Fed has started to walk back hawkish comments. Some are now saying they believe we will get a rate hike in December and then the Fed will pause. Recent price inflation deceleration helps support this argument.

Based on the most recent inflation figures published at the end of November by the U.S. Bureau of Economic Analysis, there appears to be some evidence that inflation pressure could be waning. Let’s take break it down.

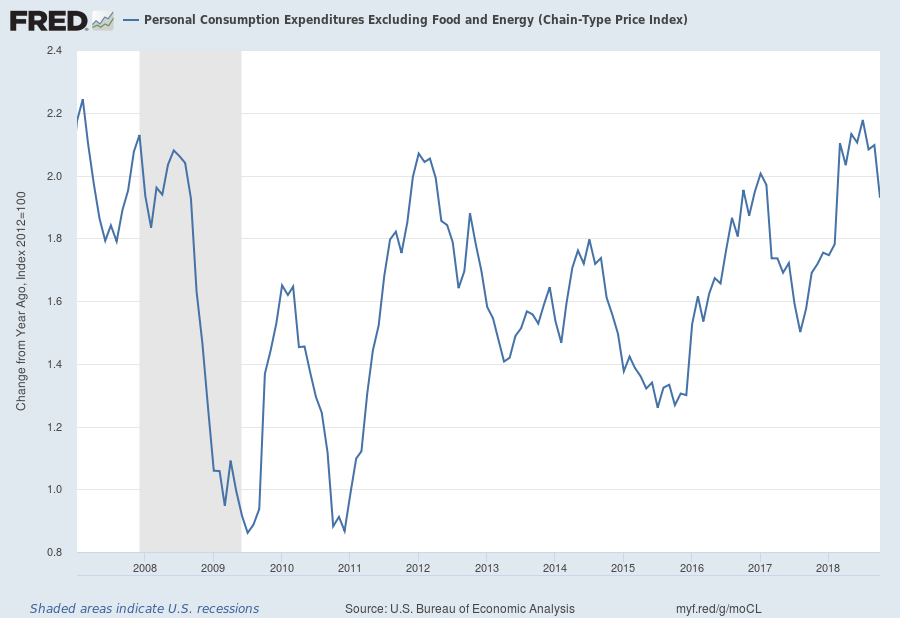

Personal Consumption Expenditures Excluding Food and Energy

The Fed’s favorite inflation metric is personal consumption expenditures deflator, excluding food and energy. Food and energy costs are excluded to better help detect trends.

The most recent data (October) shows a year over year change of 1.93%. This is down from the recent peak of 2.18% based on July data. Although it is a single data point, the direction looks promising. If data continues to run at or below 2%, the Fed should be less likely to raise rates aggressively next year.

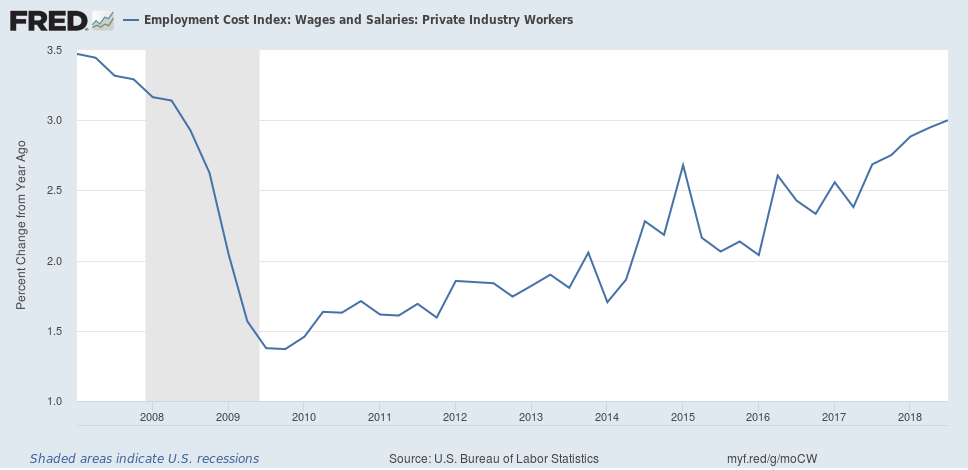

Wage Growth

Growth in wages has been steadily on the rise. Recent employment figures include healthy new jobs created and low initial unemployment claims. If initial unemployment claims rise, this is a sign the economy could be weakening. No sign so far. Based on the most recent data (Q3 2018) for the employment cost index for private workers, wages are growing at a 3% year over year rate.

How Can We Have Wage Growth Consistently Above Price Inflation for Goods and Services?

Wage inflation can lead to price inflation in goods and services because they are a component of cost. However, if a company can produce the same or higher amount of goods for a given hour of labor then prices don’t necessarily have to rise. This is productivity.

Productivity is difficult to measure and the data varies considerable quarter to quarter. Still based on the chart below, it looks as if there may be a bit of a rise in recent productivity. To help see the trend, I have included a smoothed regression (for you quants, this is a kernel smoother with bandwidth set to n-=10 quarters).

Increases in productivity would help explain why wage inflation has not translated to price inflation in goods. Of course, if we get substantial wage pressure it is possible that price inflation could follow. Yet, for now, we just don’t see it.

What Does the Federal Reserve Think?

In a speech given on November 27, Vice Chairman Richard Clarida said,

“What might explain why inflation is running at or close to the Federal Reserve’s long-run objective of 2 percent, and not well above it, when growth is strong and the labor market robust? According to the Bureau of Labor Statistics, productivity growth in the business sector, as measured by output per hour, is averaging 2 percent at an annualized rate this year, while aggregate hours worked in the business sector have risen at an average annual rate of 1.8 percent through the third quarter.”

Clarida went on to say that future business investment will be a key factor to sustaining productivity growth.

What is the Practical Implication of This?

At this point, GDP growth continues nicely. For the first three quarters, Clarita noted we have averaged 3.3%. He expects expansion to continue in 2019.

Recent market volatility is not to be ignored. However, if the Fed does temper raising rates after December and inflation continues in check next year, this would be a positive development for stocks. The rate of earnings growth will certainly slow from last year’s pace. Yet if we get continued expansion the recent volatility could be a healthy re-pricing of growth and not the beginning a large market drop.

We are staying the course for now with neutral equity weight vs. model weights. These models include bonds and defensive factors for diversification in the event things take a downturn.