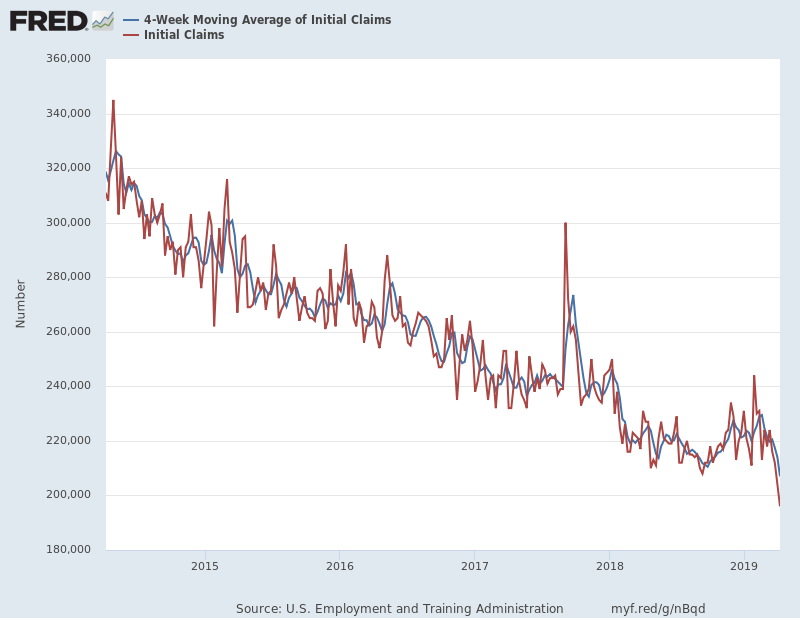

• Initial jobless claims for the week ending April 6 fell to 196,000

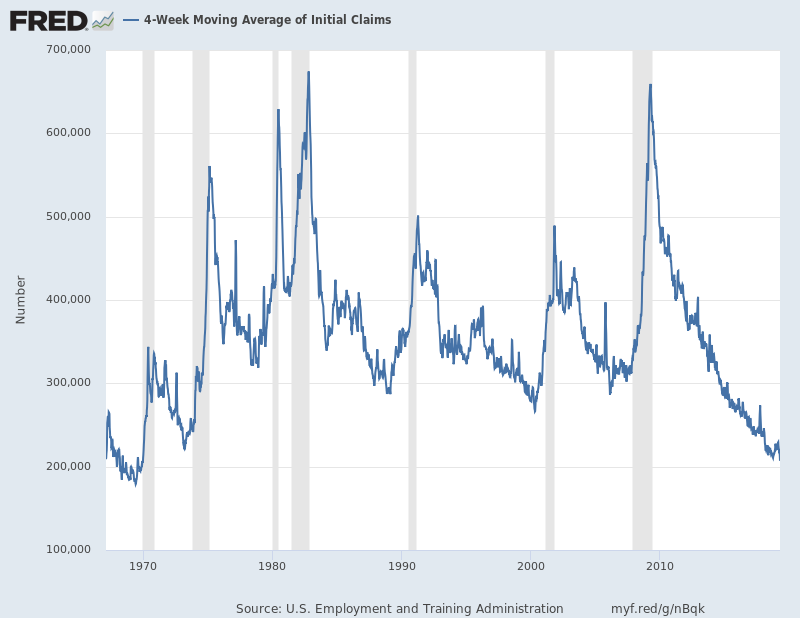

• Unemployment claims are a leading indicator for the economy

• March non-farm payroll was solid with 196,000 new jobs created

Some economists had feared that weak jobs data in February may have been signaling a weaker economy. However, job creation in March rebounded, beating expectation of 175,000 new jobs. The unemployment rate is now 3.8%, close to the Federal Reserve estimate of 3.7% for year-end 2019.

Typically, the jobless claims will rise prior to recessions and for this reason the data is used as a component of leading economic indicators.

The claims looked like they were spiking in February, but the data now looks like an outlier. Initial jobless claims have fallen four weeks in a row.

The S&P 500 50-day moving average crossed above the 200-day moving average at the beginning of the month. High yield credit spreads are 3.86%, down from 5.35% since the start of the year. The Forward PE ratio for the US equities is 17 and the job market is strong. Q1 earnings reports should give us a better picture for the second half. Slow and steady wins the race!