- The financial press and markets don’t like the inverted yield curve

- By itself, the inverted yield curve is a weak predictor for near term recession

- Credit markets, employment, and production factors should be considered

- The yield curve model is predicting 20% chance of recession while the more complete model is projecting recession risk in the next twelve months below 5%.

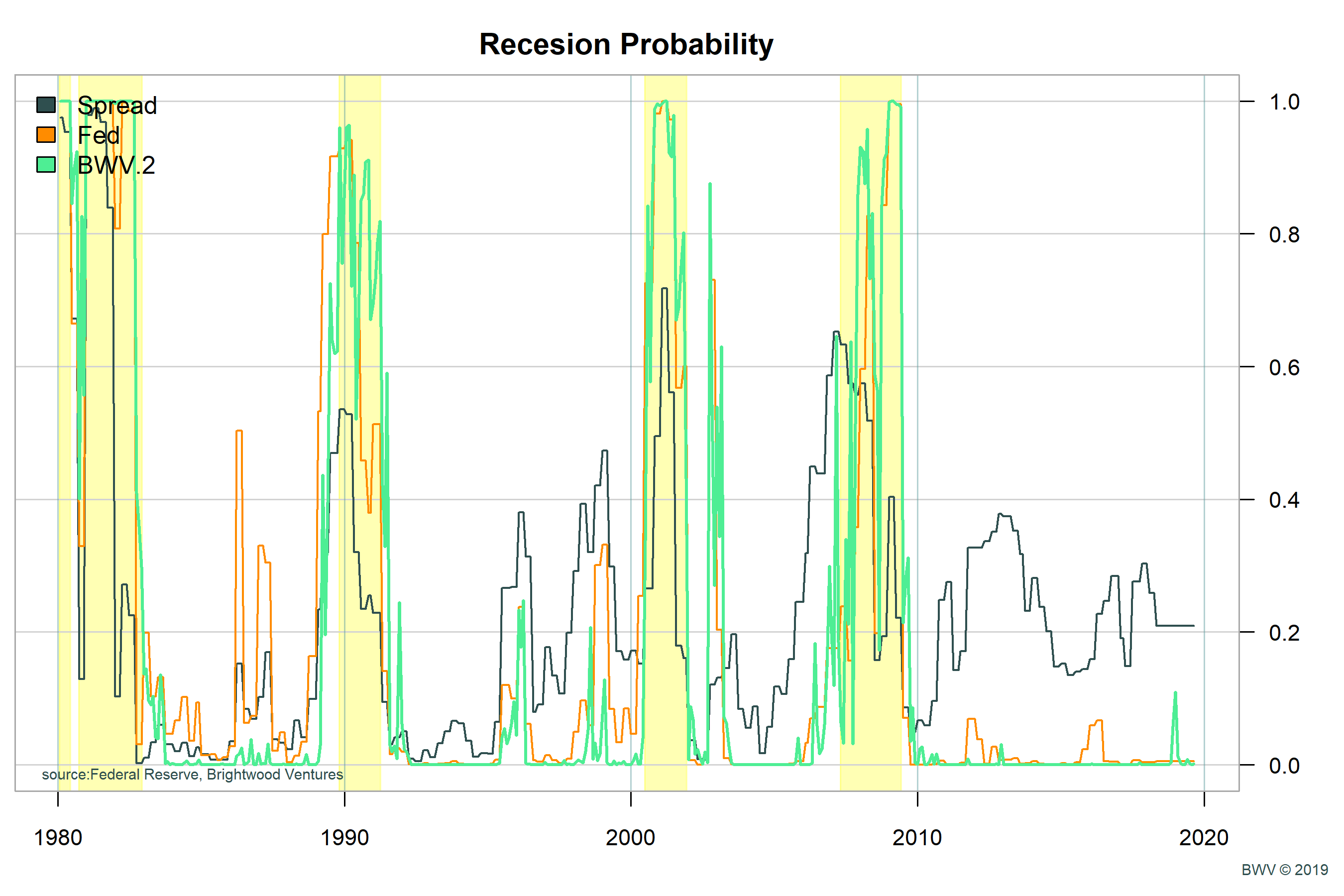

Last year I wrote a blog explaining the inverted yield curve and models used to predict recession. To recap, an inverted yield curve occurs when short-term interest rates are higher than long term interest rates. Typically, recessions have followed yield curve inversions. However, not all yield curve inversions result in a recession. What’s more, if we only look at the yield curve inversion, recessions can occur on average more then 2 years after the signal. As a result, most economists don’t rely on the yield curve alone. In fact, in the introduction article, I explained the model that the Federal Reserve uses. The Fed model uses a different measure for interest rate spread and adds additional variables for short-term treasury rates and also a measure for credit market risk called ‘excess bond premium’.

More recently, I have extended the Federal Reserve model and found that including variables for initial jobless claims, non-farm payroll and production all improve on the Federal Reserve Model. These models are complex and rely on data science for prediction. For more details contact me directly.

What do the updated models say?

First, if we use the simplistic yield curve only model (call this the ‘spread’ model), then the forecast probability for recession in the next 12 months is about 20%. Using the more complete Federal Reserve model, the probability is below 5%. Finally, my custom model also shows odds of below 5%.

Discussion

Discussion

In an August 14th interview with CNBC, Janet Yellen suggested that the yield curve inversion signal may be a false signal this time. According to Yellen, ““Historically, [the yield curve inversion] has been a pretty good signal of recession and I think that’s when markets pay attention to it but I would really urge that on this occasion it may be a less good signal,” she continued, ““The reason for that is there are a number of factors other than market expectations about the future path of interest rates that are pushing down long-term yields.”

One of the factors economists are discussing is the impact of negative yields on foreign bonds. There are over $15 Trillion dollars in bonds paying negative interest. Currently, countries such as Germany, France, Sweden and Denmark have government bonds outstanding that are paying negative interest. This could be driving down US gov’t bond interest rates down at the long end of the treasury curve and artificially contributing to the inversion. Also, long term slowing in population growth, productivity and GDP estimates all tend to contribute to lower long-term rates. The US currently has a very strong jobs market and consumer demand remains high. Industrial production has slowed a bit since last year but is still positive. While increasing trade tensions and uncertainty may ultimately drive the US into recession, the short-term indicators are not confirming recession.

We are watching industrial production, jobless claims and high-risk credit spreads very closely. If any of these indicators turn sharply negative the recession picture would become more defined. In the meantime, stay diversified with both stock and bonds – including government bonds which tend to move opposite the stock markets during uncertainty.