This week, the Federal Reserve updated their economic projections. They are now forecasting 1-2 rate cuts this year, and by the end of 2025, they predict rates will be 1% lower. The labor market remains strong with low unemployment, and the inflation rate has decreased but is still over the 2% target. Depending on the inflation measure you prefer, the CPI is running at about 3.3% annualized. The Fed is still seeking consistency in the inflation data, and the first cut is likely to occur in September or December.

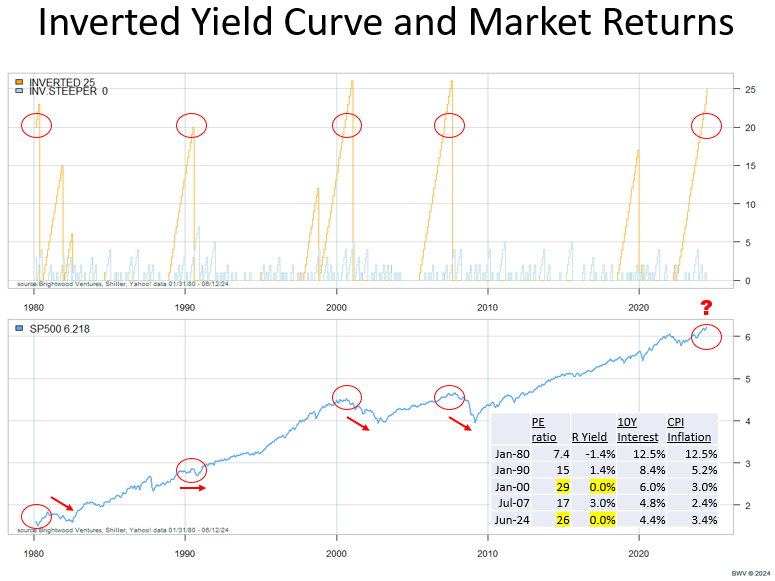

However, there are challenges. Firstly, the yield curve has been inverted for over 25 months, the longest period for this condition. Generally, the longer the yield curve inversion lasts (i.e., rates higher for longer), the more likely we are to encounter problems with banking, commercial real estate, and even recessionary impact.

A bigger concern for me right now is that US valuations are stretched, particularly in large-cap growth companies. AI has fueled price increases for companies such as Apple, Microsoft, Google, and others. While I am a tech enthusiast and use AI daily, at some point, the valuation and growth expectations get stretched too far. We are at that point. We also face geopolitical and US election risks. There are always risks, but when market valuations are high, and we have elevated risk of yield curve issues and geopolitical issues, it’s time to reassess our positioning.

Strategy

Before delving deeper, I want to remind readers about my core strategy. Generally, we have model portfolios of varying risk levels based on client situations. In addition, I make tactical shifts in stocks vs. bonds and even asset classes within sectors based on the market outlook. By definition, there is an element of timing here because we are saying we are adding to or subtracting from some exposure. However, timing is extremely difficult, and for this reason, we make adjustments that ‘tilt’ the weights to these sector views without entirely going all cash or all stock. Finally, I want to add that this article should not be considered investment advice. Investment advice and recommendations are a function of the client’s situation and their financial plan, and we tailor those individually. That said, let’s take a look at positioning.

Tilt Toward Bonds

The primary driver for tilting toward bonds and underweighting stocks is 1) relative valuation and 2) late-cycle business conditions with yield curve steepening. Today, two-year government bonds are paying 4.7%. The PE ratio for the S&P500 is 21. The CAPE (Cyclically Adjusted PE Ratio) is 26. These levels are stretched relative to the attractive 2-year rate.

The curve steepening is a bit more complicated to explain. The 10-year rate is higher than the 2-year rate, so it is inverted. This occurs about 30% of the time. Returns during inverted yield curve periods can be okay, but the real problem is when the yield curve un-inverts. What this means is that the rates are getting cut and the yield curve gets ‘steeper’. The curve goes back to the natural shape. The data shows that when the yield curve steepens, the average market return is negative. And worse yet, when the starting valuation is high, the chance of a correction increases.

Now this doesn’t mean we should entirely abandon stocks. The reason is that timing is difficult, stocks and bonds provide diversification, and finally, there are some attractive segments of the market in terms of valuation.

Quality Bonds with Duration

Before discussing the stock sectors we like, let’s start with the safer bond positioning. Many people have benefited from the higher short-term rates (3-month treasuries are yielding 5.4% today). Additionally, banks have been offing competitive CD rates. I prefer treasuries over CDs, especially in high tax states like Oregon. The treasury interest is tax-free at the state level. Not so with CD interest. Also, treasuries do not have a limit on protection, unlike the $250K limit for a bank CD with FDIC insurance. Earlier we discussed the outlook for rate cuts. Now is the time to start increasing the length of our bond portfolios. Why? You can buy a 3-month treasury with a higher yield, but when the Fed cuts rates, there is ‘reinvestment’ risk. This just means we won’t be able to get the same rate later when our bond matures, and we need to reinvest the proceeds. So above all else, I recommend folks take a look at their fixed income positioning and focus on increasing duration if you haven’t done so already. I would concentrate positioning in the 2-7 year range. The long-term bonds are not paying much more than the 10-year, and the duration risk isn’t worth the lack of premium. Finally, there are other sectors in the bond market such as mortgage-backed securities that have attractive spreads. However, most of the lower-quality sectors are not offering enough premium for the risk. Therefore, we like government bonds, mortgage-backed securities, and some of the highest-quality corporate and asset-backed securities segments.

Tilt Away from Large Cap High Growth toward Value and Quality Stocks

To illustrate just how much of a stretch there is in PE, let’s look at some data. The PE ratio for large-cap growth stocks as measured by the ETF MGK is 29.8x. Very expensive. The S&P 500 market-weighted ETF has a PE of 21x, and the equal-weighted S&P 500 ETF has a PE of 17.6x. Finally, value ETFs have a PE ratio in the 12x range. (Source: Morningstar 6/13/2024 price to prospective earnings ratio).

Given the relative value of these sectors to bonds, we are underweight stocks. However, there is still good value in some of the quality and value segments. We have not entirely abandoned tech. It’s just that we are in favor of those tech companies that have good cash flow yields relative to their growth prospects. We also like value segments in the US. Finally, I’ll mention energy. Energy stocks remain attractive on a PE basis, and in the event of geopolitical risk flaring up, the energy stocks would provide a bit of a hedge.

Illustration and Data

For those interested in a deeper dive, let me share some data and analysis. I looked at start market returns on a monthly basis from 1975-current. I broke down the data based on whether the yield curve is inverted (as measured by the 10Y minus 2Y government bond interest rate). In addition, I broke it down further into whether the yield curve was getting steeper or flatter. Practically speaking, generally when the yield curve is inverted and steepening the Fed is cutting rates and/or the economy is slowing. Finally, I take a look at valuation measure such as the PE and Real Earnings Yield for the S&P 500.

Here is some interesting statistics. The yield curve was inverted roughly 30% of all months. Roughly half of the months the curve is flatter month to month, the other half is steeper. What you find is that the market return in months with a steepening curve, the average monthly return to stocks is negative. That’s right. Also, the risk is higher as measured by both standard deviation and Conditional Value at Risk. Next, I looked at valuation. When we only consider months where the stock market valuation is excessive (as measured by real earnings yield below 2%), we find an even bigger impact. 45 months with poor valuation and steeper yield curve resulted saw an average -1.4% drop in market returns.

Now, let me temper this with context. We are still talking about data with a wide dispersion so, there certainly is no assurance the market will drop. Secondly, we have not said anything about forecasting. We don’t know with certainty whether the Fed will cut rates. So, there is an element of timing here that cannot be forgot. That said, we certainly can say that we are in a period with an inverted curve and a very likely possibility that Fed will cut rates. With high stock market valuations we think being partially underweight the high PE stocks is a good idea.

- Inverted Yield Curve, Flatter month over month: +1.3 /average

- Inverted Yield Curve, Steeper month to month: -.3% / average

- Inverted Yield Curve, Steeper .and. high price: -1.4% / average

- Bonds during Same Period: +.4% / average

In the first panel we have plotted an orange line for those periods with inverted yield curve and the number of consecutive months the curve is inverted. The blue line is the consecutive number of months with steepening curves. From panel two we can see that of the four mature episodes of yield curve inversions since 1980, there does appear to be a relationship between the amount time we have been inverted and the onset of market corrections. It seems odd, but the market declines typically occur as the Fed is cutting rates. Let me repeat that, it is common for the market to bottom AFTER the Fed starts cutting rates. Finally, the second panel includes data with the PE ratio, Real Yield, 10Y Rate and CPI inflation for the noted periods. Jan 2000 and June 2024 are noted in yellow due to the common theme: high PE and low real earnings yield. It is true in Jan 1980 we had poor real earning yield but the PE ratio was very low. I certainly would be less concerned about Fed rate cuts and steepening curves if we had a better PE ratio. For these reasons, we want to tilt away from high PE, high growth large caps that are by many measures over extended.