This week Morningstar updates its 529 plan ratings. This article focuses on the Oregon College Savings Plan. This plan enables investors to purchase funds directly and is managed by TIAA CREF. MFS also offers a set of funds that are sold through advisors. Morningstar continues to rate the Oregon plan as ‘Neutral’. The plan made small changes in 2015 to the equity allocation of some of the age-based plans.

Morningstar rates the plans based on five pillars: process, performance, people, parent, price. Details on the rating system can be found here. Process measures the fund investment methodology. Performance measures risk adjusted return. People pillar measures the manager’s talent. The parent pillar measures the firm’s stewardship and price is an assessment of the value of the fund relative to comparable funds.

How does the Oregon plan rank across these categories? The plan receives neutral marks for process, parent and price. The plan receives a negative mark for performance and a positive mark for people.

According to Morningstar analyst Gretchen Rupp, the plan ‘offers a reasonable lineup for a wide audience, but the price is not compelling overall’. Gretchen’s analysis notes that the age-based portfolios largely follow an indexed based approach and therefore fees should be low. The Oregon plan adds .22% in fees for board oversight and program management. The average fees for the age-based funds are roughly .3%, putting the Oregon plan in the middle of the pack.

Fund Options

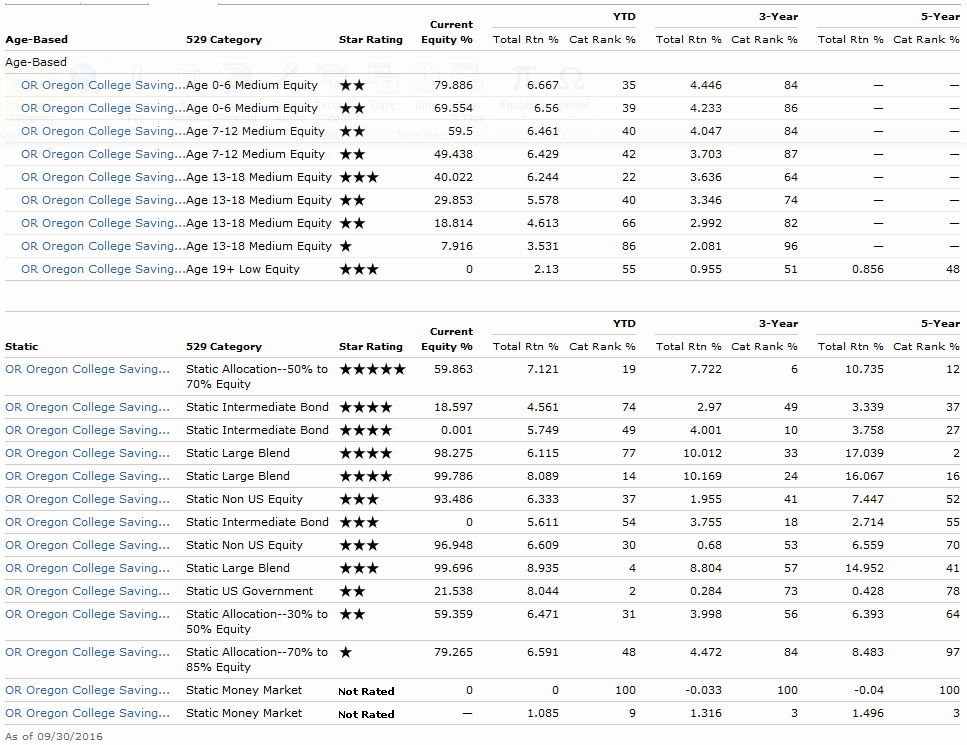

The Oregon plan includes both age-based options and static funds. Age-based plans vary the allocation to riskier assets such as stocks based on the age of the student. By the time students reach college age, the Oregon plan reduces equity exposure to 0%. In addition to the age-based funds, there are a number of static funds, meaning that the asset allocation does not change based on age. These funds include both actively managed funds as well as index funds. Fund expenses vary from .27% for the US Equity Index option to .7% for the Diversified US Equity fund. There are several 4 and 5 star funds in the static category including indexed based stock and bond funds. However, these funds also include the added expenses for program management and oversight. For an updated version of this data, please visit the following Morningstar page.

Source: Morningstar Research, updated 10-25-2016

Summary

Although the program earns a neutral rating, the tax benefits for participating in the Oregon plan still makes it attractive to many Oregon residents. Single filers can deduct up to $2,225 and joint filers can deduct up to $4,530. In Gretchen’s view, ‘a generous tax benefit creates appeal for Oregon residents, so while the plan may not display many overwhelming strengths, it remains a reliable workhorse for in-state investors’.

If you have questions on saving for college, the Oregon plan, or specific fund options please don’t hesitate to get in touch with us.