As we started the year, the S&P500 was trading at a P/E multiple of 20.35 based on actual 2015 earnings. High by historical measures, but fairly valued under a scenario where interest rates remain low.

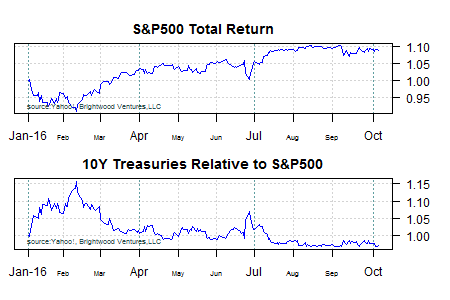

Markets Started the Year with a Dip

Volatility picked up in January and the markets dipped. Sales and earnings growth were negative and fear, as measured by the VIX index, spiked. Ten year treasury bonds started the year outperforming the S&P500. Ten year treasury rates dropped to just 1.37% on July 8th (source Federal Reserve of St. Louis DGS10 series). Rates have climbed back to 1.75%.

Given high valuations, the prospect of rising interest rates and the view that we are closer to the end of the business cycle than we are to the middle, we moved to a more defensive position implemented using quality and low volatility smart beta tilts.

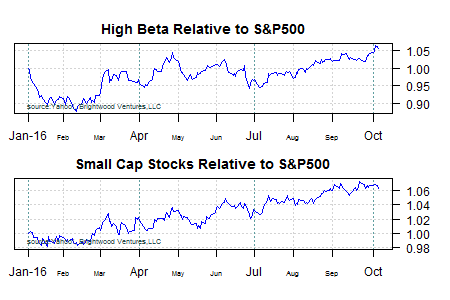

From mid-Q1 High Beta Stocks Drove Markets Higher

As Q2 began, the VIX index had dropped to 13.95 down from a high of 28.14 on February 11th. Another interesting way to look at the ‘risk on’ mentality of the market is to look at individual sectors of the market relative to the market itself.

The next chart gives us another picture of the ‘risk on’ behavior that took over. The chart shows relative performance of high beta stocks (as represented by the S&P500 high beta portfolio etf (ticker = SPHB) relative to the S&P500 stocks (as represented by the S&P500 etf (ticker = SPY)).

The second panel shows the relative performance of small cap stocks (as represented by the S&P Small Cap etf (ticker = IJR) relative to the S&P500.

From the chart we can see that both high beta stocks and small cap stocks have outperformed the S&P500 for the year.

The P/E multiple for 2016 based on actual first half earnings and second half earnings expectations is 19.62. This presumes that earnings in the second half will grow a whopping 24.6% over last year second half earnings. (source: S&P500 indicies 10-06-2016 data)

The Federal Reserve announced in late September that they would hold interest rates at their current levels. After forecasting multiple hikes for 2015 and 2016, the Fed has raised rates just one time last December to their current level of .4%. The market took this as another all clear signal and high-beta stocks put in another leg up from that point.

What is our outlook?

Q3 earnings season is upon us. Valuations are high. High earnings growth is already built into the stock prices. Fear is low. We have the election coming up.

I’d like to see some real proof that earnings are starting to recover before moving away from quality and low volatility stocks. With 10 year rates at 1.75 and the current earnings yield on the S&P500 at 5.5% on a trailing basis and 55% on a forward basis the current market risk premium is somewhere in the 3 – 3.75%. I just can’t see a strong argument for taking on more risk for such a low premium.