• In it’s March 15 statement, the Fed said that, ‘in the near term the [Russian] invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity’. The Fed raised rates just .25%

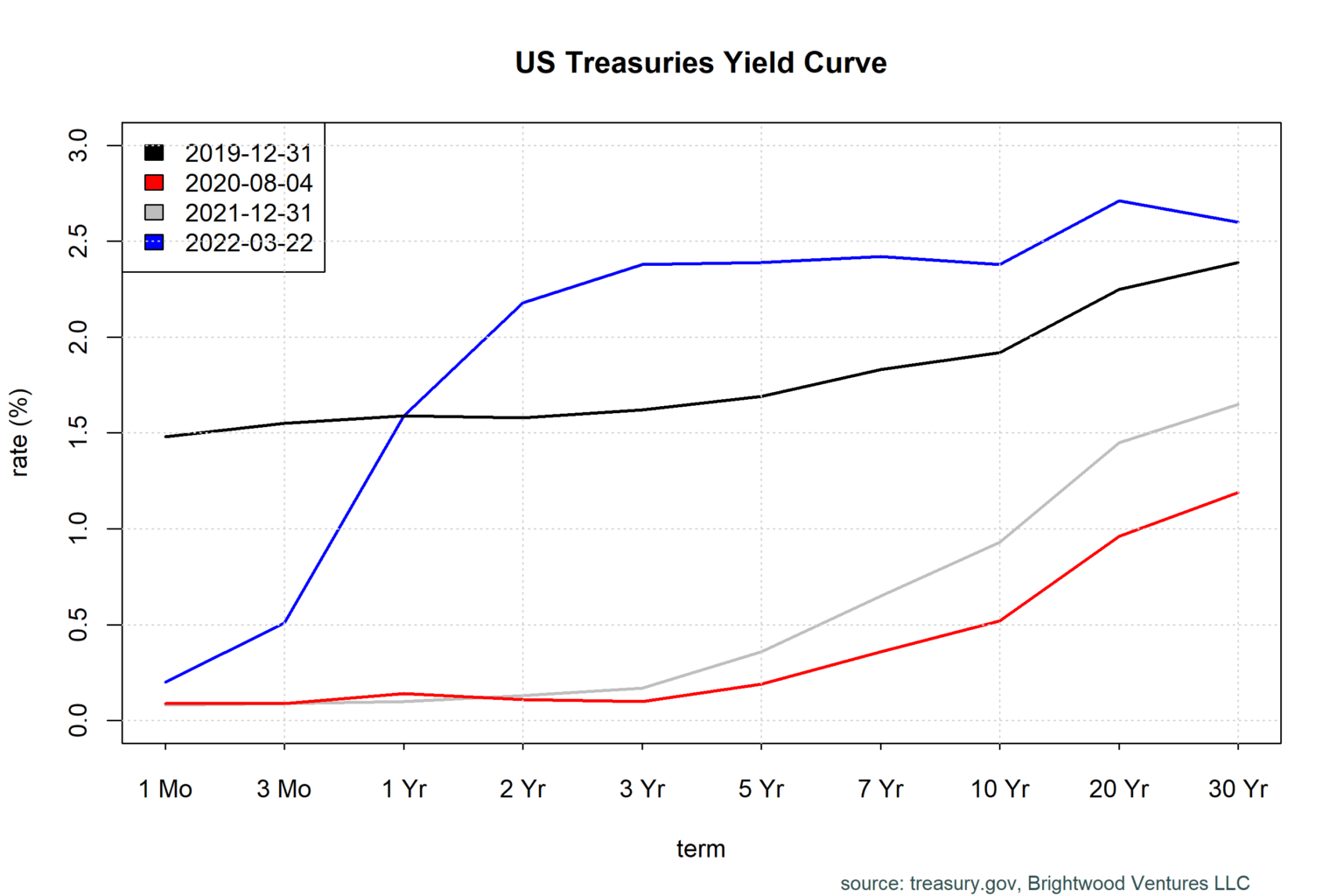

• Bonds rates have risen sharply this year and most of the yield curve is now well above pre-pandemic levels.

• The 2-year rate stood at 2.18% as of March 22nd, compared to the current Fed Funds effective rate of .25%

The Federal Reserve has continued to underestimate the size and duration of the inflation generated as a result of the pandemic and associated policy decisions. In the latest statement the Fed explained that, “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” They noted the likely impact of the Russian invasion of Ukraine.

There are a number of signals that suggest that the market has lost confidence that the Federal Reserve is going to aggressively tackle the problem. Let’s break it down.

Bond Rates higher than Pre-Pandemic Levels

Below I plot the treasury yield curve based on data through March 22. We can see from the blue line that the rates are now well above the black line for most of the curve. The blue line is the government bond rates from March 22nd. The black line is the government bond rates from December 2021, just prior to the pandemic.

Notice also how ‘flat’ the yield curve looks. When the 2-year rate goes above the 10-year rate, we say the yield curve is inverted. Many believe an inverted yield curve signals a recession is coming.

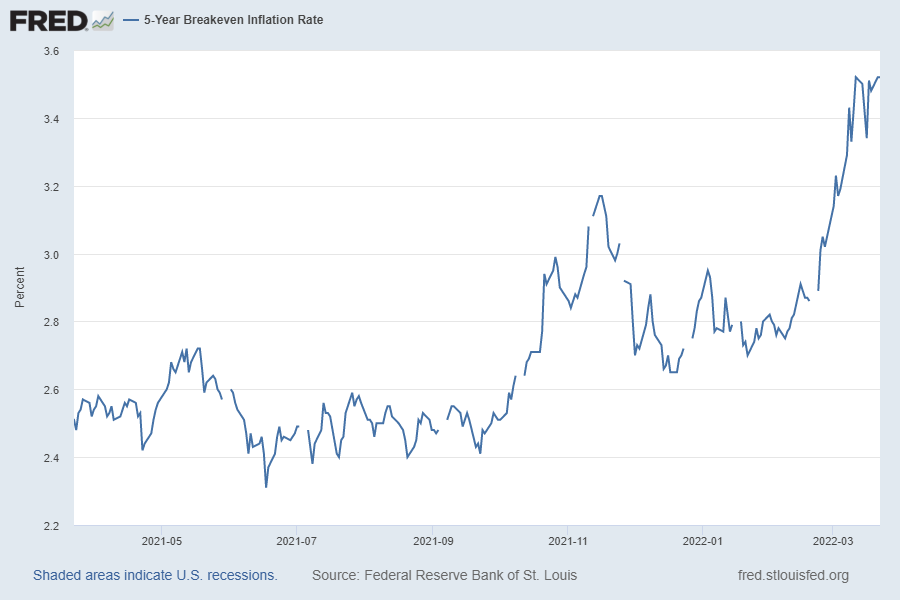

5-Year Break Even Inflation Rate

For most of 2021, the break-even inflation rate as priced by the market for 5-year government bonds compared to 5-year inflation protected bonds (5-year break-even rate) hovered around 2.5%. In the last 3-4 weeks we have seen a large rises in the break-even rate. As of March 22, the rate is 3.52%.

This large spike in rates suggests that that the market thinks we will have much higher sustained inflation and/or that they do not believe the Federal Reserve will act aggressively enough to tamp down inflation in the short term

Fed Funds Rate Lags the 2-year rate by almost 2%

With the Fed Funds rate at just .25% and the 2-year government bonds trading at 2.14%, the gap between the two rates is at a near historical high for the period from 1990 – current. The average is roughly .4% and the current gap is roughly 2 standard deviations from the mean.

Powell says Fed will hike further and faster if necessary

After the March 15th meeting, several Federal Reserve members made public statement suggesting the Fed needed to be more aggressive and raise rates faster. In an unusual move, Powell then came out just a few days later indicting the Fed will be more aggressive if needed.

What are the Implications?

Interest rates and inflation are critical inputs to understanding where to invest going forward. Rising rates cause price drops in bonds and eventually will also hurt the stock market due to discounting effects.

Uncertainty in inflation, interest rates and GDP growth cause companies to be more cautious on hiring and expanding.

The Fed is in quite a pickle here. If they raise rates hard enough to really put a lid on inflation, they risk bringing on a recession. If they go too slow, the market will lose confidence and markets will continue to be volatile.

We are in unchartered water given the massive stimulus and government interest rate interventions taken during the pandemic. Trying to predict, let alone time investment shifts to profit from the rate moves is extremely difficult. This is one of the best arguments for staying diversified with a good balance of fixed income and stock investments. In effect, using the diversification across the asset classes to smooth out any volatility.

Normalization of interest rates, inflation and GDP growth will take a few years to play out.