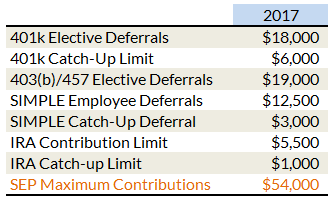

IRS contribution limits to retirement plans for 2017 are largely unchanged. The maximum SEP contribution limit has gone up $1,000 to $54,000.

IRS contribution limits to retirement plans for 2017 are largely unchanged. The maximum SEP contribution limit has gone up $1,000 to $54,000.

Taxpayers can deduct IRA contributions if they meet certain conditions. One condition is that deductions are ‘phased out’ based on your level of income. The phase-outs also depend on whether the taxpayer or their spouse is covered by a retirement plan at work. Finally, the phase-outs are different for traditional IRAs vs. Roth IRAs. The phase-out limits have changed slightly in 2017. In most cases, the ranges have gone up $1 – $2,000. For example, a single taxpayer covered by a workplace plan has a deduction phase-out limit range of $62,000 – $72,000 for a traditional IRA and $118,000 – $133,000 for Roth IRA.

If you have questions about phase-out limits that apply in your case you can find the detail at the IRS website here or feel free to give me a call and I can help you find the answers.