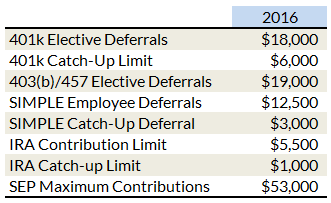

Last month the IRS announced 2016 Pension Plan / 401(k) Contribution Limits.  401k elective deferrals remain unchanged at $18,000. As well, catch-up contributions allowed for those 50 and older are unchanged at $6,000.

401k elective deferrals remain unchanged at $18,000. As well, catch-up contributions allowed for those 50 and older are unchanged at $6,000.

Several of the phase-out limits were adjusted up. For IRA contributors not covered by a workplace retirement plan and is married to someone who is covered, the deduction is phased out between $184,000 and $194,000 (up $1,000 from 2015). The AGI phase-out for ROTH IRA contributions is $184,000 to $194,000 for married couples filing jointly (or $117,000 to $132,000 for single filers).