• The Case-Shiller National Home Price index hit a record high adjusted for inflation at the end of March

• At the same time, new home starts fell 13 percent month over month in April

• Builders are facing issues with increased raw materials costs, labor shortages and affordability issues

Over the long run, home prices are consistent with long term inflation. Of course, we have seen very large swings in the short term. According the Case-Shiller National Index of single family homes, the single family home prices rose 13.5% year over year in March. Of course, all real estate is local. In Portland, Oregon, the year over year increase is up just about 13.1%.

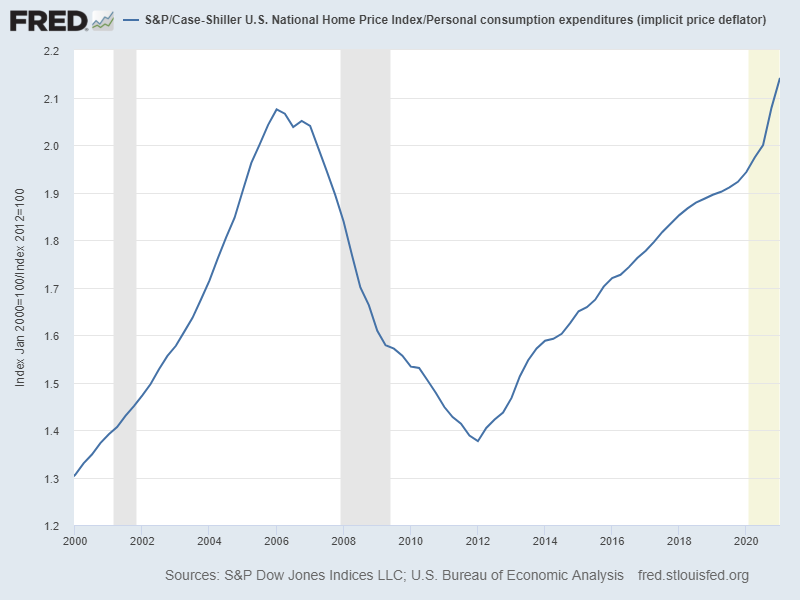

If we look at housing prices adjusted for inflation, we can see that prices have reached an all-time high. For the next graph, I simply divided the Case-Shiller Index by the Personal Consumption Index Deflator.

S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. National Home Price Index [CSUSHPISA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPISA, May 25, 2021.

What is Causing the Rapid Growth

Many factors go into home prices. When mortgage rates fall, you can buy more house for the same monthly payment. The pandemic created a supply-demand imbalance as demand for housing has been very strong while supplies have been historically low.

Robert Shiller, the co-founder of the S&P CoreLogic Case-Shiller home price index is worried about a housing bubble forming. On a recent CNBC interview (5/24 CNBC Trading Nation), Shiller said, “I don’t think that the whole thing is explained by central bank policy. There is something about the sociology of markets that is happening.”

Why are Builders Reducing New Home Starts?

Several factors are contributing to the fall in April new starts. Raw materials prices are rising quickly. Supply chain shortages have also been noted in appliances. Some industry observers are noting that there are shortages of workers. Finally, there is a question of affordability.

In reviewing the most recent DR Horton earnings call (4/25), DR Horton noted that the average sales prices have risen dramatically above the $300,000 mark. For years, the average price of a new DR Horton home seemed to be pegged at this number. DR Horton executives said they position themselves targeting affordability. They make decisions at a local level based on market prices as well as based on reviewing underwriting conditions for borrows.

What can we expect going forward?

One noted expert on multi-family housing, Ken McElroy suggested that home buyers watch the average number of days for a home to sell. In certain markets that number has fallen to two weeks or under. When the inventory is so low, prices naturally get driven up.

Shiller indicated that we are still seeing high momentum in the housing market and that prices may take longer than a year to cool. “If you go out three or five years, I could imagine they’d (prices) be substantially lower than they are now.”

Glenn Kelman, CEO at Redfin, believes housing prices are set to cool. In a recent Bloomberg interview he said, “I think you’re going to see a bit of air come out of the balloon.”

At present, it isn’t clear if prices will cool in the short run or the long run, but given the fact that we are now at a cyclical peak in long-term prices a strong case could be made that prices will slow. If mortgage rates climb (which is possible if inflation persists and the Fed has to raise rates) the price slow-down would gain traction. Without wage growth and sustained low mortgage rates, continued growth would be unsustainable.

Sources:

DR Horton Inc (DHI) Q2 2021 Earnings Call Transcript

Home construction sees biggest drop since pandemic hit. Here’s why