Did the Fed Depress the US Economic Recovery?

In a recent blog post Dr. Ed Yardeni, a noted economist, opined that the Federal Reserve contributed to depressed economic recovery in the US. He cited three very interesting arguments and I thought it may be of interest to summarize his thoughts here. (source: www.blog.yardeni.com May 26, 2015)

Dr. Yardeni argued three key points:

• Low interest rates driven by Fed policy have caused savings rates to go up (and therefore have reduced the amount of consumption).

• Ultra easy money attracted investors into the housing market, driving up housing prices and making it less affordable for first time home buyers.

• Corporations used funds to buy-back shares of their companies rather than invest in growth projects.

Let’s break down these arguments and look at a bit of data.

Personal Savings Rates

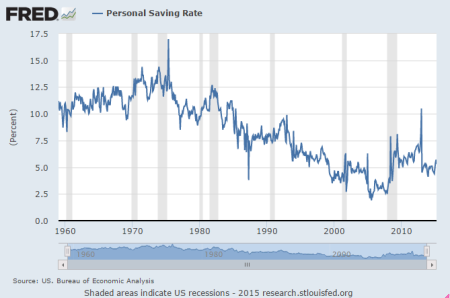

Macroeconomic theory would suggest that as interest rates fall, household savings would go down. To wit, from 1980 to the financial crisis, personal savings rates in the US trended down from greater than 10% down to a low of approximately 2.5%. As the crisis unfolded and interest rates declined with Fed easing, personal savings rates increased to above 5%. This may be explained by risk-averse investors withholding spending due to uncertainty about their future. Many economists have speculated that the recent slowdown in 2015 GDP growth has been impacted by an increase in personal savings.

Macroeconomic theory would suggest that as interest rates fall, household savings would go down. To wit, from 1980 to the financial crisis, personal savings rates in the US trended down from greater than 10% down to a low of approximately 2.5%. As the crisis unfolded and interest rates declined with Fed easing, personal savings rates increased to above 5%. This may be explained by risk-averse investors withholding spending due to uncertainty about their future. Many economists have speculated that the recent slowdown in 2015 GDP growth has been impacted by an increase in personal savings.

Home Purchases

Yardeni argued that the distorted financial environment created incentives for investors to enter the residential real estate market for investment purposes. This has resulted in an increase in home prices, making homes less affordable for first time home buyers. Blackstone, LLP comes to mind. Blackstone is the largest private equity firm in the US. After the financial crisis they began aggressively buying US homes and operating them for rental income. Blackstone owns over 50,000 homes today. Blackstone issued bonds at very low rates to finance the purchase of these homes. The bonds are backed by the rental receipts from the homes. The top rated bonds at time of issue in 2013 yielded about 1.4%. Analysts estimated that the net cash flow return before bond payments would be 5.4% to Blackstone. With debt financing available under 2%, Blackstone was able to generate returns well above current bond yields. (source: Blackstone Bets Big on Rental Homes http://www.bloomberg.com/infographics/2013-12-20/blackstones-big-bet-on-rental-homes.html)

Corporate Stock Buybacks

Finally, Yardeni argued that corporations repurchased company shares, given that bond rates were below their earnings yield. He suggested that they invested in repurchasing rather than investing in new plant and equipment. Certainly we know that stock buybacks and debt issuance for corporations have been strong. However, I don’t believe that the choice of buybacks vs. investment is mutually exclusive. Companies look for projects for investment that exceed their cost of capital. In low rate environments, the bar for investment should go down. In short, if there is demand and there are projects that can generate an acceptable return then we should expect investment as well as stock buybacks. Overall, this may be the weakest of the three arguments.

Conclusions

Dr. Yardeni raises some interesting points in arguing that the Federal Reserve low interest rate policy may have hurt the pace of recovery. He outlined three specific ways that consumption would have been reduced. We often hear that the Fed has created ‘distorted’ market conditions. While the Fed desires to spur growth through low interest, it may be that unintended consequences have actually dampened their ability to have a meaningful impact.