The US stock market volatility continues. The S&P500 is down roughly 10% for the year before dividends. At the start of 2016 we modified our model portfolios to shift to a more defensive posture. We are currently market neutral on equity weighting relative to our benchmarks. We are overweight in the US and underweighted in international equities. We have biased the portfolio toward quality, defensive sectors (healthcare) and low-volatility in international equity.

Much has been written about China, the price of oil and the US dollar, but what about sales and earnings growth and outlook? Over the long term, we know equity returns derive from earnings. Based on current earnings estimates of $124.29 and a closing price of 1853.44 (2/8/2016) the market is trading at a forward PE of 14.9. This is roughly in the middle of the range we have traded in since the beginning of 2013 (source: Factset).

How Do Sales and Earnings Look for the S&P500 Companies?

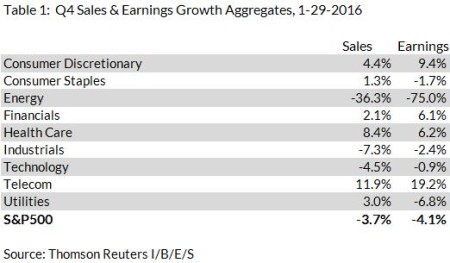

As of January 29th, 200 of the 500 companies in the S&P500 have reported their Q4 2015 results. Based on the aggregate results, the year over year sales growth for Q4 was -3.7%. Earnings declined 4.1%. The aggregate numbers don’t give us a complete picture. Let’s take a look at sales and earnings growth by sector in the following table.

From the table we can see that there is a high degree of variation across the reporting sectors. The energy sector has been hit hard by the continued decline in oil prices. At the end of 2014, oil was trading for $52 per barrel. By the end of 2015 oil slid to $37 a barrel. This year, oil fell to under $30 a barrel. In January, Moody’s announced that they are considering downgrading 120 oil & gas companies and 55 mining companies. Some argue that lower oil prices should be good for the economy as consumers have more dollars in their pocket to spend. While this may be true, the reason fear remains is that low oil prices may also be signaling a slowing world economy. The discussion gets complicated because oil supply and the strength of the dollar are major factors as well.

In addition to the energy sector, the industrials and technology sector have reported declining sales. Earnings growth in industrials, technology and consumer staples have declined on a year over year basis.

Significant Factors

Generally, year over year declines in revenue and earnings are not favorable for the stock market. GDP growth rates in the US remain positive while unemployment rates and wage growth continue to show some strength. Recent manufacturing data looks very weak but the consumer and services sector remain relatively stable.

The US dollar has strengthened considerably over the past several years. At the end of 2015 EUR/US stood at $1.20. The dollar peaked in March and has fallen back a bit since that time. The stronger dollar puts pressure on US companies that export. The dollar strengthened as the US Fed started to unwind QE and made the first rate hike in December. Notwithstanding the wide held believe that the dollar will continue to rise with additional hikes, history tells us that much of the dollar rise may already be priced in at the point of the first rate hike.

Oil, the dollar and equity markets: Some have argued that the strong dollar was largely to blame for the oil decline. Also, the stock market has been moving in strong correlation to the spot oil price.

While the current state of sales and revenue growth look shaky, According to Factset, Analysts are estimating revenue for 2016 will grow by 2.2% while earnings will grow 4% over 2015.

Conclusions

Our current premise is that we are closer to the end of the business cycle than the beginning. The Fed has started to raise rates and credit market spreads are signaling that the credit cycle is coming to an end. As such, we have biased our model portfolios to increase exposure to fundamental factors and sectors that should outperform the broad market in a decline.

We will continue to watch sales and earnings figures very closely. Valuations are below recent peaks but above long term averages. Under our views of subdued inflation, low interest rates and low single digit GDP growth we remain diversified across stocks and bonds and hold a neutral equity weighting. If we start to see weakness in revenue and earnings outside of the energy and materials sector we may look to cut our exposure to beta even further.