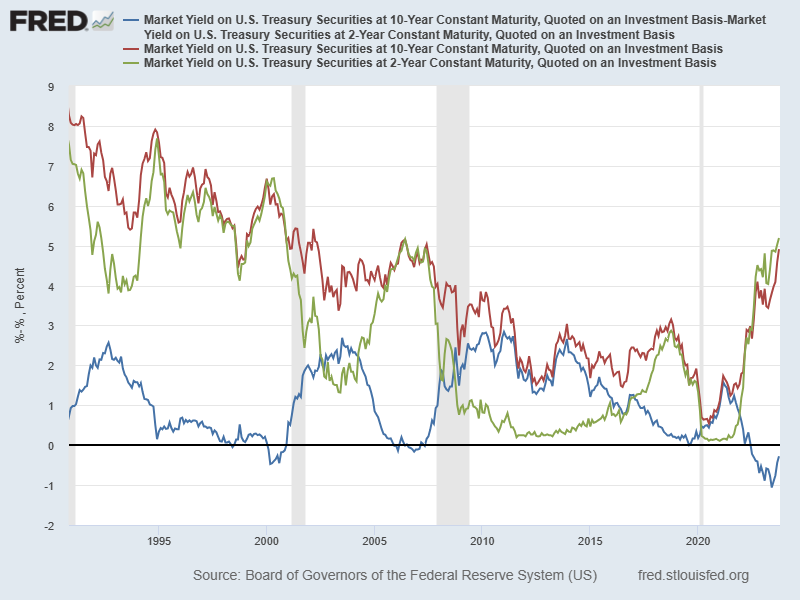

• Ten Year Treasuries touched 5% on October 19th, up 1.43% since Jan 1.

• Two-year rates exceed ten-year rates in July of 2022 (yield curve inversion).

• In the past, yield curve inversion has always signaled recessions.

• The recessions typically have occurred 18-24 months after inversion.

Over the course of the past months, the Fed has continued to signal that rates would remain higher for longer. The market has received the message and longer term interest rates have responded. The benchmark ten-year treasury rate hit 4.996% yesterday. We haven’t seen rates at 5% since July of 2007, before the great financial crisis.

In comments made yesterday, chair Jay Powell indicated that financial conditions are ‘not too tight’ and that recent increases in long-term rates do help to tighten financial conditions. Yet, a strong economy could induce the Fed to make additional short term rate increases.

If we look at a longer term history of the ten-year and two-year rates, we can see that recessions not only follow yield curve inversions with a lag we also note that the curve un-inverts before the onset of recession. Given the recent rise in long-term rates that yield curve un-inversion is now underway. This is a signal that we are watching carefully.

What do higher long-term rates mean for the economy and investments?

As noted above, higher long-term rates do help to tighten financial conditions. Businesses and consumer have to pay more to borrow money. Mortgage rates have recently gone over 8%. This is slowing the number of home sales because new buyers are forced to pay higher monthly payments with higher rates. Seller’s don’t want to sell their home with low rates and be subjected to a new mortgage with higher rates. Businesses also face higher rates to borrow and invest in new projects. Tighter credit lending standards also make it more difficult to get loans approved.

Regarding investments, higher long-term rates have a huge impact. Interest rates are ‘the price of money’. Investors demand higher return for risky assets. So, if safe bonds are paying a higher interest rate, any risky investments like stocks or real estate need to generate higher returns. To generate higher returns, the asset prices have to come down (assuming earnings and rents stay the same).

How are we positioning portfolios now?

For the fixed-income portion of portfolios, we have favored low duration bonds for some time. Now, with long-term rates rising it is time for investors to begin to think about adding duration. The reason is that real interest rates are now close to 2.5%. In addition, the term premium for longer term bonds has turned positive. Finally, if we do go into a recession the short-term rates will be cut by the fed and maturing bonds would face lower returns upon re-investment. Timing interest rates is very difficult. That said, typically, the yield curve un-inversion means that peak rates have been reached. In this cycle, the long-rates have been slow to react so, we do need to be balanced in how we react. Also, US debt is out of control and the US treasury has to issues about $500 Billion in bonds every quarter. There is a good chance that long-term rates remain elevated and even go up from here, given that the government doesn’t seem to be doing anything at all to cut deficit spending and deal with a debt to GDP ratio of over 120%.

On the equity side of the house, we have been underweight stocks relative to client target portfolio risk weights. Of course, if we do go into a recession as predicted by the inverted yield curve, the market would undergo a correction. My base case now is that we will go into a mild recession in the first half of 2024. I put the odds of that at 70%. Recession is on everyone’s mind, but I have an insight here. We care more about the relative value of each asset class and in this sense, we don’t really even need to predict a recession. Given that interest rates have risen show sharply and stock prices have held up, the relative value of bonds vs. stocks continues to climb. We are at the point where the price of stock compared to bonds means that the premium for holding stocks is lower than it was 6 months ago.

Since the pandemic in 2023, we have seen wild swings in interest rates, monetary policy and fiscal spending and stimulus. The volatility in financial markets will remain until we get back to some kind of stable reality.